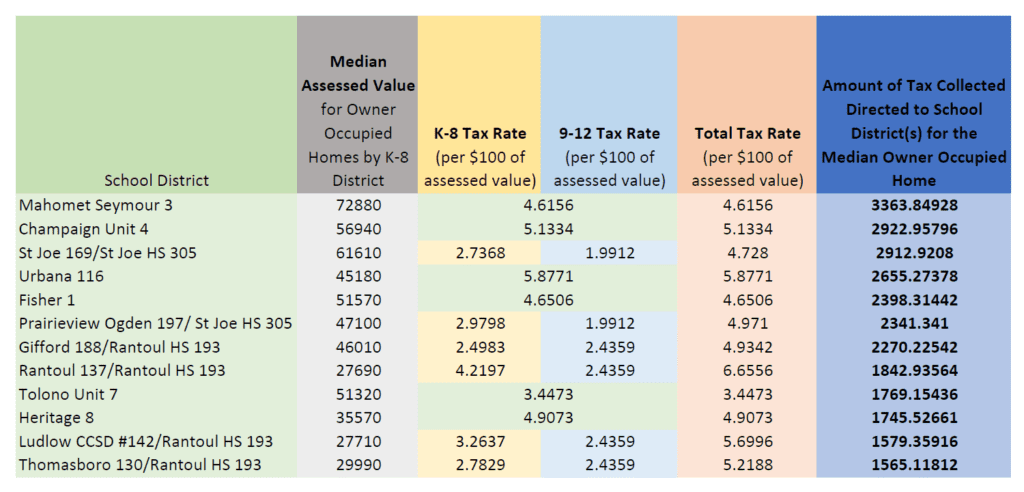

The SJO Daily acquired the EAV (Equalized Assessed Value) reports from the Champaign County Assessors office and the FY 2020 (payable in 2021) tax levy rates from the Champaign County Clerk’s office to make the following chart that shows tax rates and median home values for each school district in Champaign County.

The following rates and amounts do not reflect a homeowner’s entire tax bill. In Mahomet, for example, residents within the Village of Mahomet also (in addition to school district taxes) pay taxes to the Village, Champaign County, the Champaign County Forest Preserve District, the Cornbelt Fire Protection District, the Mahomet Public Library, Parkland College, “Road and Bridge”, Mahomet Township.

Tax levy rates for FY 2021 (payable in 2022) were approved by all taxing bodies in December (2021), but the finalized rate will not be available until March or April (2022).

It is important to note that because some districts split as students go to high school, we only used the median home values for the K-8 district.